FAQ

Frequently Asked Questions

Sunergy has been in business since Decemeber 2017. This is when we received our contractor’s license and our general liability insurance. Although Sunergy Renewable Systems is a relatively new company it’s owners and employees have more than 20 combined years of experience.

Yes, you would pay us for the cost of the solar panel system and we take care of everything from there. This would include the panels, inverters, the mounting system, electrician, trenching, bobcat work, permits, interconnection paperwork, etc.

Return on investment (ROI) is a performance measure used to evaluate the efficiency of an investment or compare the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment's cost.

The modified accelerated cost recovery system (MACRS) is a depreciation system for businesses which allows the capitalized cost basis of assets to be recovered over a specified life of the asset by annual deductions for value depreciation. MACRS is the depreciation system used in the United States, and was created after the release of the Tax Reform Act of 1986.

In Iowa, a solar panel system will pay itself off in about 7-10 years for residential and about 5-7 years for commercial with some electric companies. The life expectancy of a solar panel system is about 30+ years.

While hail certainly could damage some types of solar panels, the likelihood is very small and occurrences are extremely rare. Many solar panels are made with tempered glass. The substrate is a flexible plastic material that highly resistant to damage from rock and hail. Most home owner policies will cover hail damaged solar panels.

Many homeowners make the mistake of thinking that they have no use for a tax credit because at the end of the year they owe very little or in some cases they may even get money back from the IRS. The best way to illustrate how to use a tax credit is by showing an example.

In this example, our customer Joe Smith earns $52,000 in 2015. Joe is paid $1,000 each week and $150 is taken out of his paycheck every week for federal income taxes.

At the end of the year Joe’s tax professional tells him that he owes $10,000 in federal income taxes after accounting for all of his deductions. Joe has already paid a total of $7,800 ($150 x 52 weeks) worth of federal income taxes out of his weekly paycheck. Assuming Joe has no tax credits he will owe the IRS $2,200 ($10,000 - $7,800) in additional income taxes.

Now let assume that Joe purchased a solar power system in 2015 for $20,000. The system qualifies him for a federal tax credit of $6,000 (30% of $20,000). This tax credit reduces Joe’s 2015 federal income taxes from $10,000 to $4,000. Since Joe has already paid $7,800 worth of income taxes out of his weekly pay checks, he will receive a tax refund of $3,800!

*Disclaimer: Sunergy Renewable Systems is not a tax professional. We strongly recommend talking with a tax professional to see how the tax credit will affect you.

No, batteries are not needed. Batteries are only required in a grid tied/battery back system and in an off grid system.

It depends. If you install a grid tie system (the most common system) the solar will not work. This is because the National Electric Code mandates that the inverter needs to shut down to prevent feeding electricity back to the grid. If electricity continues to feed back to the grid during a power outage this could cause a potentially hazardous situation for the linemen working on the grid.

If you install a grid tied/battery backup system, then in the event of a power outage the solar will disconnect from the electric grid and will continue to supply electricity to the house.

Solar power, like other renewable energy resources, has many environmental and health benefits. Going solar reduces greenhouse gas emissions, which contribute to climate change, and also results in fewer air pollutants like carbon monoxide, sulfur dioxide and particulate matter, which can cause health problems.

Net metering allows homeowners with solar power systems to feed energy back into the utility grid and receive credits when their systems are producing more energy than they are consuming in their homes. This allows homeowners to bank credits during the summer months when systems are producing more due to the increased sun exposure, and use those credits during the winter months when systems generate less due to shorter days.

Studies have shown that homes with solar energy systems sell for more than homes without them. However, your property value will only increase if you own, rather than lease, your solar panel system. In most parts of the country, going solar will actually increase your property value more than a kitchen renovation.

It is possible to go off the grid with a solar energy system that includes battery storage, but it will cost significantly more and is unnecessary for the majority of homeowners.

The amount of power your solar energy system can generate is dependent on sunlight. As a result, your solar panels will produce slightly less energy when the weather is cloudy, and no energy at night. However, because of high electricity costs and financial incentives, solar is a smart decision even if you live in a cloudy city.

Solar panels collect the energy from the sun and convert it into direct current (DC). It is then sent to the inverter where it is converted into alternating current (AC) which can be used in your home or sent back to the grid to offset your electric bill.

Solar panels convert sunshine into power, so if your panels are covered in snow they can’t produce electricity. Snow generally isn’t heavy enough to cause structural issues with your panels, and since most panels are tilted at an angle the snow will slide off. If snow does accumulate, your panels are easy to clean.

Solar is a simple, minimum-maintenance technology. Unlike other energy technologies, solar electric system contains no moving parts. This means it’s not likely your equipment will fail. You should not have to replace your panels at all during their lifetime. Wiring is the part of solar PV that most commonly requires maintenance because squirrels and other animals may tamper with it. Even in those cases, damage tends to be minimal. Solar panels do not need to be washed, as rain and snow naturally clean them.

There are a few rebates and incentive available which helps improve your return on investment. The federal tax credit that is avaible to everyone in the United States (see question number 4 above). Many states also include a state tax credit and/or other incentive program along with the federal tax credit. Ask a Sunergy associate for more information about the area you live in.

If you can afford to pay your electricity bill you can afford to go solar. $0-down solar financing options, including both solar loans and solar leases, make it easy for homeowners with good credit to start saving on their electricity bills by going solar.

There are many financing options available for solar. Some options are:

Cash Purchase:

- Maximize your savings by owning a secure long-term investment.

- Use federal investment tax credit to reduce your tax liablity.

- May be able to use other state tax credits and/or incentives.

- Increase the market value of your home.

Lease or PPA:

- Receive the benefits of having solar with little or no money down.

- Avoid the responsibility of maintence and repairs.

- Do not have tax liability to monetize the federal tax credit.

Loan:

- Numerous low-cost, low interest rate loan programs are availiable.

- “Own” an asset that generates significant financial value, unlike other home improvement loans.

- Achieve immediate savings, as you repay the loan over time.

For most people buying a solar system out right gives the best return on investment. With a solar lease or solar power-purchase agreement (also known as a "PPA"), a customer pays for the solar power system over a period of years, rather than in an up-front payment. Often customers can purchase solar for little or no money down, and often realize energy savings immediately. In a power-purchase agreement, a customer agrees to purchase all the energy from a solar system over a fixed period of time.

The size of your solar energy system will depend on how much electricity you use on a monthly basis, as well as the weather conditions where you live. We take your previous 12 months of electric bills and information from the NREL to determine what size solar panel system you need.

Solar energy systems can last for 25 to 35 years, and it can be costly to remove and reinstall the solar panel array if you need to replace your roof. If your roof needs maintenance in the near future, you should complete it before you finish your solar installation. We work with reputable roofing companies if you need assistance in determining the condition of your roof.

In general, solar panels are very durable and capable of withstanding snow, wind, and hail. The various components of your solar power system will need to be replaced at different times, but your system should continue to generate electricity for 25 to 40+ years. NASA put solar panels in space in the 1950’s that are still going strong.

If you own your solar energy system, your solar house will sell at a premium: studies have shown that solar increases property values. However, if you lease your system, that is not the case. You will need to either buy out your lease before you sell your home, or work with your leasing company to transfer the lease agreement to the home’s new owner.

If you have multiple quotes from different solar installers, comparing them can be difficult. Not all solar installers use the same underlying assumptions and metrics when they provide equipment and financing options to homeowners. Talk with the installer and ask a lot of questions. Verify what is included in the quote. Verify that the solar panel systems are of comparable size and quality.

There are many different type of inverter on the market today. The 3 main types are micro-inverters, string-inverters, and hybrid-inverters. Ask a Sunergy assoiciate for more information.

A common term that sales companies and manufacturers use is the 'Tier 1' rating. The Tier rating was developed by Bloomberg New Energy Finance Corporation and is basically used to rate solar panel manufacturers in terms of financial stability. Unfortunately a Tier 1 ranking does not mean a panel offers the highest performance, quality or the longest warranty. With most established panel manufacturers now rated as Tier 1, it is more important than ever to know how to distinguish a high quality and reliable panel by other means.

No, you do not need a solar monitoring system in some areas of the country. At Sunergy Renewable Systems we include the monitoring with every install at no extra charge. This is so we can monitor your system for any problems and also aids us in diagnosing problems if any should arise. We pride ourselves on selling good investments and we feel the only way for our customers to get a good ROI (Return On Investment) is to keep their solar panel system up and running efficently.

There are a few criteria that everyone should use when choosing a solar installer. Confirm that they are certified, licensed and insured, have relevant experience, and can provide references. Meet with your solar installer in person before you sign an agreement to ensure that you are comfortable working with them. Jon with Sunergy Renewable Systems is NABCEP certified.

Experience: It’s important to assess the installer’s installation experience. How many installations have they completed? How many were systems similar to your own in size, design, and materials? In addition to installation experience, installers should be familiar with the permitting and interconnection procedures relevant to your property. How many installations have they completed in your jurisdiction and utility territory?

Reviews: When researching prospective installers, be sure to ask for customer references. How were other peoples’ experiences with the company? Consider checking online reviews at sites like Google Reviews, Facebook, Yelp Reviews and the Better Business Bureau.

Materials: With hundreds of manufacturers and products on the market, it can be hard to know what the best panel, inverter, and racking system is for your property. You’ll want to ask your installer what components they offer and what their experience has been with those manufacturers. Should you desire a specific type of material (an American-made panel, for example) you should express that preference upfront with your installer.

Labor warranty: Labor warranties cover the workmanship of the installer, most likely covering their electrical wiring and roof penetrations. These differ from installer to installer, so it’s important to know what each installer offers when choosing between companies. Be sure to ask if the warranty fully covers roof penetrations when researching labor warranties. Some installers do not offer that coverage under warranty. If having a robust, long-term labor warranty is important to you, ask your installer if they offer an option to upgrade to a longer warranty period.

Licensing and certifications: While no universal solar license exists, a leading industry certification to look for is NABCEP (North American Board of Certified Energy Practitioners), which Sunergy Renewable Systems has. All installation crews should include at least one person who is NABCEP certified. You should request a copy of your installer’s contracting license.

Southerly-facing roofs with little to no shade and enough space to fit a solar panel system are ideal for installing solar. However, in many cases there are workarounds if your home doesn’t have the ideal solar roof.

Every electric company does their electric bills different. In most cases it will show up on your bill as a Solar, Renewable or Distributer Generation energy credit.

- We come to your house and do a site survey, we measure the area that the solar will be installed, do a shade analysis, and take pictures of your load center and electric meter.

- We size your solar panel system to the last 12 months of electric bills and the available space we have to work with where the solar will be installed.

- We then present you with our quote and go through the quote with you and explain the quote and answer any questions you may have.

- We then get the interconnection approval from the electric company and order the materials.

- We install the solar panel system.

- Get it inspected.

- Get the electric company to commission your solar panel system.

- Finally we present you a book containing a copy of your quote, all engineering drawing, all warranties, and any other information that you may need in the future.

Solar will pay for itself. The amount of time it will take to pay for itself depends on many things like the tilt and azmuth of the array, shading issues, rebates and incentives just to name a few.

A solar roof mount system mounts to the unused space on the roof of your house. This is ideal if you live in town and don’t want to lose space in your yard. A ground mount system mounts on the ground. The advantage of a ground mount system is that the tilt and azimuth can be set to the ideal settings, the panels run cooler which makes them more efficient, and the snow can be easily removed after a snow fall which causes the panels to produce sooner than a roof mount system would.

For many reasons. It helps you to save a lot of money so it is a good investment, you are doing your part to save our environment, and it also helps to protect your roof.

Some companies in the area will sell you a solar panel system and then sub-contract the install and charge a mark-up in price. At Sunergy Renewable Systems we believe a company should take you from start to finish. We size the system, present you with the quote, order the materials, install the system, have it inspected, and get the electric company to commission your solar panel system. This will help to keep costs down to improve you return on investment and keep quality high.

With the companies that sell solar and sub-contract the install to other solar companies, who do you call if you have a problem with your solar panel system, the company that sold the system or the company that installed the system? We take full responsibility in every aspect of the job. This eliminates the confusion of who to call if there is ever a problem with your solar panel system.

While a south facing roof is ideal for a roof mount, a roof that is facing more to the east or west will still have good production. This will affect the ROI a little but should still be a good investment. The way that some electric companies pay for solar and the time of day rates they charge and the home owner’s life style a west facing roof may be a better option than a south facing roof.

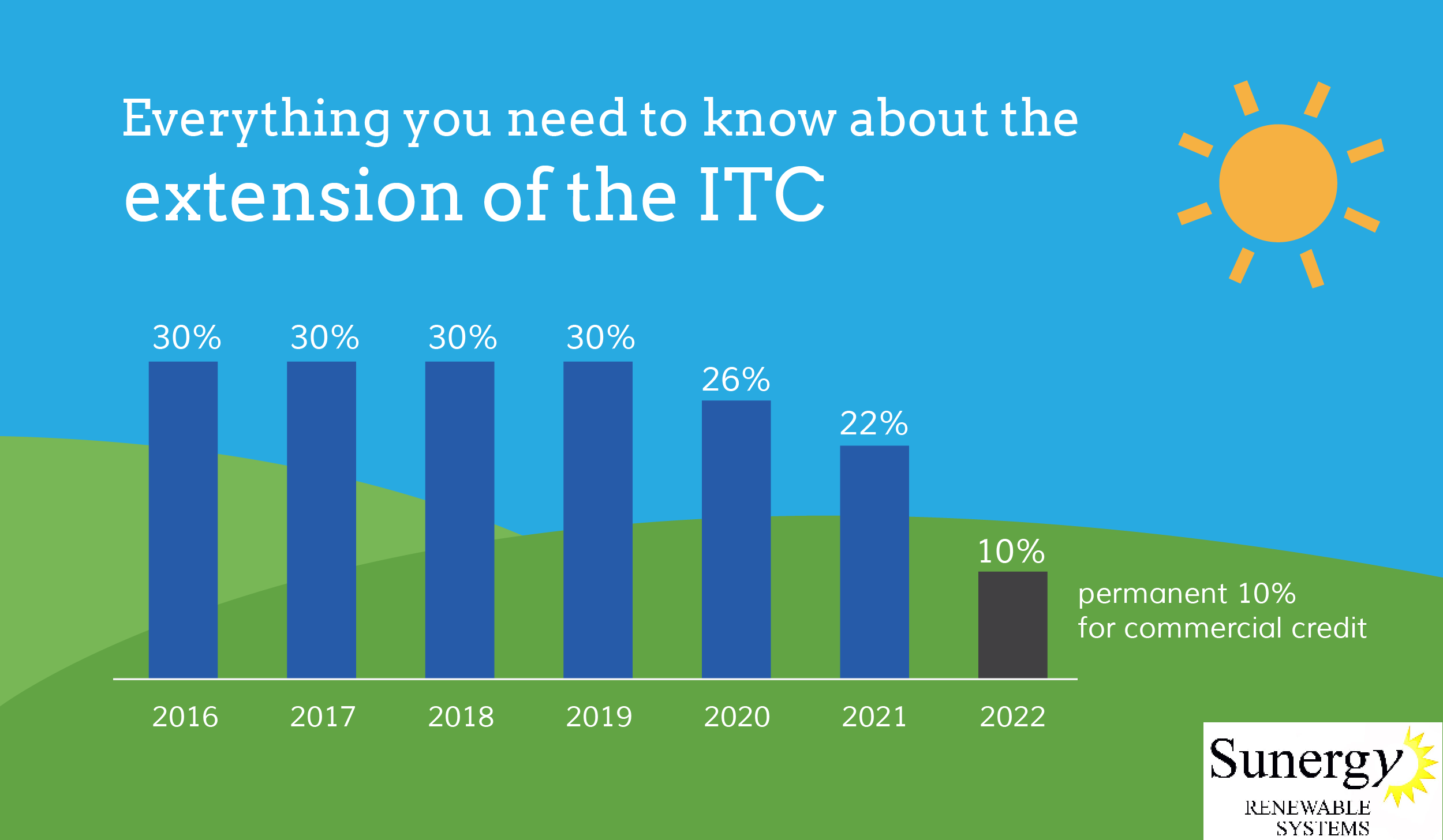

2019 is the last year for the 30% federal tax credit. The next 2 years the federal tax credit will drop 4% per year. 2022 the federal tax credit will no longer be available for homes and it will only be worth 10% for commercial buildings. 2023 the federal tax credit will no longer be available for commercial buildings either. The majority of the inverters produced today are in the high 90% range for efficiency so there isn’t much room left to improve the efficiency of the inverter while the solar panels may become more efficient, this just means that they will take up less square footage. Waiting for new technologies means losing that production during the waiting time for new technologies that may not make up for it.

Simply put – the sooner you get solar, the sooner you will enjoy its benefits! If you wait for some unproven technology down the road, you will have missed the opportunity to generate your own power now. Solar is like saving for retirement – the sooner you start doing it, the better.

To determine how much roof space and how many panels you need depends on how much electricity you use and how much of your bill you would like to offset.

There are other options like a ground mount system. Some panels can be mounted on your roof while the remaining panels can be installed on a ground mount system minimizing the physical size of the ground mount. The other option is just to offset a smaller percentage of your electric bill.

Sunergy will always install a monitoring system with every solar install at no extra charge so we can monitor the system to make sure there are no problems so you can get the best return on investment. If you have access to the internet through a computer or a smart phone you can monitor your system for production and to make sure i t is working correctly anywhere in the world.

Yes. Installing solar panels can significantly increase your property’s value, according to a new study from the Lawrence Berkeley National Lab (LBL). The report, titled “Selling into the sun: Price premium analysis of a multi-state dataset of solar homes“, builds on previous research which concluded that homes with solar panels in California sold for more than those without.

In addition to California, the new study investigates home pricing trends in Connecticut, Florida, Massachusetts, Maryland, North Carolina, New York and Pennsylvania by analyzing the sales of over 20,000 homes in these states. LBL’s analysis of the housing markets in these other states shows that the premium paid for homes with solar is not a phenomenon isolated to the Golden State. The clear takeaway: solar panels really do add value to a home.

If you are thinking about purchasing a solar system for your home, the study’s conclusions should give you a boost of confidence that you are making a smart investment. LBL finds that homes with solar panels will benefit from a ‘solar premium’ when they are sold because buyers are willing to pay more for a home with solar panels

While solar does increase the value of your home it does not increase your property tax at this time.

Solar power inverters are relatively quiet – emitting about as much noise as a refrigerator or computer. They are generally installed in utility rooms, basements or garages alongside existing mechanical systems, rather than in living spaces.

Snow and ice are a reality of installing solar arrays in the Midwest and we design our systems to take snow into account and to withstand the toughest weather we get. The reality is, after a snowstorm, your solar panels will be covered in snow. Don’t panic! Usually they ‘self-clear’ quite well on the next sunny day. On an annual basis, the amount of energy production loss due to snow is fairly minor.

An average a solar panel system for a home is generally between $15,000 and $25,000 but there are exceptions too.

Photovoltaic panels can use direct or indirect sunlight to generate power, though they are most effective in direct sunlight. Solar panels will still work even when the light is reflected or partially blocked by clouds. Rain actually helps to keep your panels operating efficiently by washing away any dust or dirt. If you live in an area with a strong net metering policy, energy generated by your panels during sunny hours will offset energy that you use at night and other times when your system isn't operating at full capacity.

Depending on your electrical usage and available space to install the solar panel system you can produce enough power to offset 100% of your electric bill.

It typically takes one to two months for an installer to design your solar array and secure initial permits (from your municipal government) and interconnection agreements (from your electric utility). Depending on your exact solar permitting office and utility interconnection team, this could take anywhere from a few weeks to a few months. Once initial permits and interconnection agreements are in hand, your installer will typically need only few days to physically install your array (panels, inverter, racking system, and wiring). The installer will then need to get final approval from the municipal permitting office and secure final interconnection approval from the utility. This can take an additional one to three months depending on the jurisdiction.

Yes, with batteries it is very possible to disconnect from the grid. This is a more expense option but it can be done.

Yes. If that is something that you are interested in doing you should tell us when we design the quote. It takes a certain type of inverter to do this so the most cost effective way of going about this is in the beginning.

No, with the equipment that we have we can install a ground mount on a varity of landscapes. If you have land that isn’t much good for any thing it might be the perfect place to mount a ground mount solar panel array. We may be able make your unusable land usable.

The internal rate of return (IRR) is a metric used in capital budgeting to estimate the profitability of potential investments. The internal rate of return is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. IRR calculations rely on the same formula as NPV does.

Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. NPV is used in capital budgeting and investment planning to analyze the profitability of a projected investment or project.

LCOE is used to compare the relative cost of energy produced by different energy-generating sources, regardless of the project’s scale or operating time frame. As Thomas Holt and his co-authors define it in A Manual for the Economic Evaluation of Energy Efficiency and Renewable Energy Technologies, LCOE is determined by dividing the project’s total cost of operation by the energy generated. The total cost of operation should include all costs that the project incurs—including construction and operation— and may incorporate any salvage or residual value at the end of the project’s lifetime. Incentives for project construction and energy generation can also be incorporated.

The federal solar tax credit, also known as the investment tax credit (ITC), allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes through 2022. The ITC applies to both residential and commercial systems, and there is no cap on its value.

The federal ITC was originally established by the Energy Policy Act of 2005 and was set to expire at the end of 2007. A series of extensions pushed the expiration date back to the end of 2016, but experts believed that an additional five-year extension would bring the solar industry to its full maturity. Thanks to the spending bill that Congress passed in late December 2015, the tax credit is now available to homeowners in some form through 2034. Here are the specifics:

2016 - 2019: The tax credit remains at 30 percent of the cost of the system. This means that in 2019, you can still get a major discounted price for your solar panel system.

2020 - 2021: Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes.

2022 – 2032: President Biden signs the Inflation Reduction Act. Owners of new residential and commercial solar can deduct 30 percent of the cost of the system from their taxes.

2033: Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes.

2034: Owners of new residential and commercial solar can deduct 22 percent of the cost of the system from their taxes.

Contact us today to schedule a free consultation and cost estimate!

License #: C132504

Solar Contractor

License #: C132504